Your company has invested heavily in laptops, computers, and other tech gadgets but over time, their value drops due to wear and tear or because newer models come out. Without tracking proper depreciation of digital assets, you might end up with a financial headache, overestimating your assets and facing unexpected tax issues. Let’s dive into what IT asset depreciation is and how to calculate and stay on top of it.

Key Takeaways

- Depreciation tracks the value loss of IT assets like laptops and servers over their useful life.

- Tangible IT hardware (computers, servers, printers) depreciates; intangible assets like software follow different rules

- Straight-line, declining balance, and units of production allocate asset costs based on usage or time.

- Asset cost, salvage value, and useful life (3-5 years for laptops, 5-7 for servers) drive calculations.

- Automates depreciation tracking, customizes rules, and optimizes value recovery through resale or recycling..

- Regular audits, maintenance, and asset management systems extend IT asset life and maximize returns.

What is Depreciation and How Does IT Asset Depreciation Work?

Depreciation is the term we use for the loss of value of a fixed asset during its lifetime. Generally speaking, depreciation only occurs in fixed assets, such as property, equipment, machinery, and IT assets, as they are tangible, physical assets that your business owns.

IT assets, which include computers, laptops, servers, and networking equipment, are considered fixed assets because they have a useful life extending beyond one accounting period and provide economic benefits over time.

Although both fixed assets and other intangible assets, such as trademarks or branding, show on your company’s balance sheet for accounting purposes, only fixed assets can be depreciated for tax purposes.

IT asset depreciation is calculated based on their cost, salvage value, and useful life, allowing businesses to systematically allocate the cost of these assets over their expected useful life, reflecting their gradual wear and tear or obsolescence.

Identifying Assets for Depreciation

When considering depreciation, businesses must first identify qualifying assets. Tangible IT hardware, such as computers, laptops, servers, networking equipment, printers, and peripherals like monitors and external drives, are typically subject to depreciation. These assets have a useful life extending beyond one accounting period and are expected to yield economic benefits over time.

Each type of IT asset may vary in useful life and IT asset depreciation rate based on technological advancements and usage. For example, shelf life of laptops and computers are generally last 3 to 5 years, while servers and networking equipment may extend to 5 to 7 years.

Considering residual or salvage value is crucial. While many IT assets have negligible salvage value, it impacts depreciation calculations by determining the remaining cost to depreciate over their useful life.

Intangible assets, such as software licenses and patents, also require depreciation, but follow different rules and calculations. Software licenses are amortized based on expected usage duration, considering updates or changes in business needs.

Accurate identification and categorization of IT assets for depreciation ensure precise financial reporting, optimize tax benefits, and effectively manage technology investments.

Determining Depreciation Factors

Several factors come into play when calculating depreciation for IT assets:

1. Asset Cost: This refers to the total expenditure incurred to acquire and prepare the asset for its intended use. It includes the purchase price, installation costs, and any additional expenses directly attributable to bringing the asset into service.

2. Salvage Value: Also known as residual value, this is the estimated amount the asset is expected to be worth at the end of its useful life. In the case of IT hardware, salvage value is often negligible.

3. Assets Useful Life: This represents the period over which the asset is expected to contribute to the business. For IT equipment, useful life can vary based on technological

4. Advancements and usage patterns. The useful life for laptops and computers lies between 3 to 5 years.

Choosing a Depreciation Method for IT Assets

There are several ways you can choose to depreciate your assets, It is important to understand which method will benefit your company more than others.

Depreciation methods determine how the cost of an asset is allocated over its useful life. Common depreciation methods applicable to IT assets include:

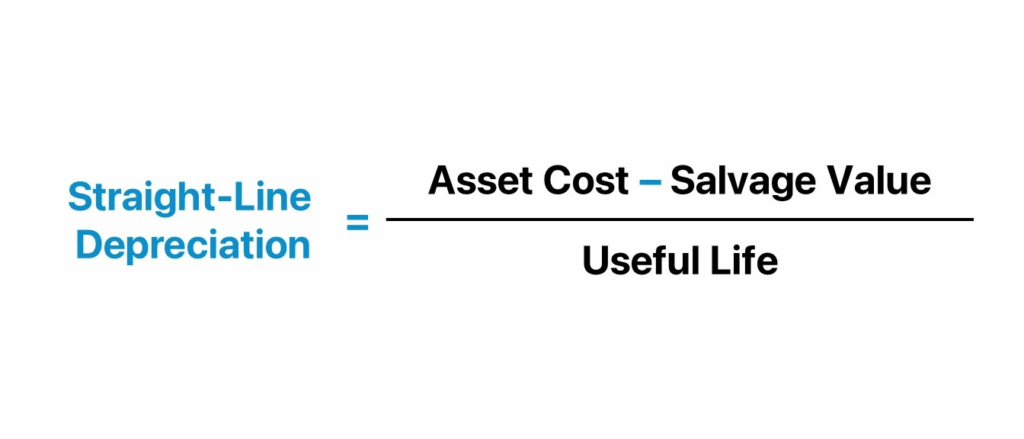

☑ Straight Line Depreciation: This method evenly distributes the depreciation expense over the asset’s useful life. It is straightforward to calculate and provides a consistent expense each accounting period.

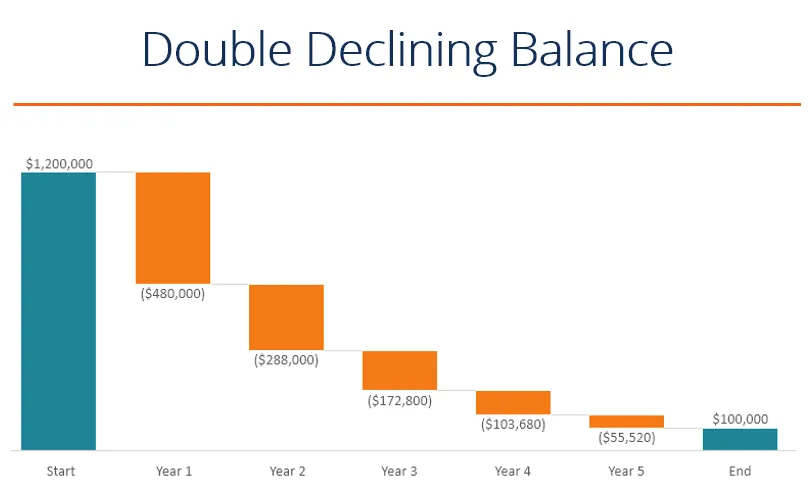

☑ Declining Balance Depreciation: An accelerated method that front-loads depreciation expenses, resulting in higher expenses in the early years and lower expenses in later years. This method reflects the reality that many assets lose more value in their early years of use.

☑ Units of Production Depreciation: This method links depreciation to the asset’s usage or production levels. It is particularly useful for assets like printers that wear out based on their usage.

☑ The sum of the years’ digits method: The sum of the years’ digits method recognizes that higher expense was incurred in the early years of the asset’s life.

Depreciation Calculation

The depreciation value is determined by applying the chosen depreciation method to the asset’s cost, salvage value, and useful life. Let’s explore how each method calculates depreciation:

- Straight Line Depreciation: Depreciation per year = (Cost – Salvage Value) / Useful Life

- Declining Balance Depreciation: Depreciation per year = (Book Value at the Beginning of the Year) x (Depreciation Rate)

- Units of Production Depreciation: Depreciation per unit = (Cost – Salvage Value) / Total Units of Production

- Sum of the years’ digits method: Depreciation expense = (remaining life/sum of the years’ digits)

Pro Tip: Partnering with an ITAD company like Unduit can help you easily calculate your asset depreciation using the Manage app, while optimizing your asset lifecycle.

Depreciation Rates for Laptops

Straight-Line Method:

Calculate by dividing the difference between an asset’s cost and salvage value by its useful life: (Total asset value – Salvage value) / Useful life. Ideal for consistent depreciation, it simplifies forecasting and tax savings but may overlook usage variations or technological obsolescence.

| Year | Depreciation Rate (%) | Cumulative Depreciation (%) | Remaining Value (%) |

|---|---|---|---|

| 1 | 20% | 20% | 80% |

| 2 | 20% | 40% | 60% |

| 3 | 20% | 60% | 40% |

| 4 | 20% | 80% | 20% |

| 5 | 20% | 100% | 0% |

Declining Balance Method:

Calculate by multiplying the current book value by a fixed depreciation rate: Current book value × Depreciation rate. Ideal for assets like computers needing more repairs later, it’s GAAP-compliant and tax-efficient but complex and rigid, risking inaccurate assessments if misapplied.

| Year | Depreciation Rate (%) | Cumulative Depreciation (%) | Remaining Value (%) |

|---|---|---|---|

| 1 | 40% | 40% | 60% |

| 2 | 24% | 64% | 36% |

| 3 | 14.4% | 78.4% | 21.6% |

| 4 | 8.64% | 87.04% | 12.96% |

| 5 | 5.18% | 92.22% | 7.78% |

Depreciation Rates for Mobile Devices

Straight-Line Method:

Depreciate mobile phones evenly over their useful life using (Total asset value – Salvage value) / Useful life, ideal for consistent tax savings and forecasting, but it may overlook usage variations and rapid technological obsolescence.

| Year | Depreciation Rate (%) | Cumulative Depreciation (%) | Remaining Value (%) |

|---|---|---|---|

| 1 | 33.33% | 33.33% | 66.67% |

| 2 | 33.33% | 66.66% | 33.34% |

| 3 | 33.34% | 100% | 0% |

Declining Balance Method:

Calculate by multiplying the current book value by a fixed depreciation rate: Current book value × Depreciation rate. Ideal for mobile phones requiring increased repairs over time, it’s GAAP-compliant and tax-efficient but complex and rigid, potentially leading to inaccurate valuation if misapplied.

| Year | Depreciation Rate (%) | Cumulative Depreciation (%) | Remaining Value (%) |

|---|---|---|---|

| 1 | 50% | 50% | 50% |

| 2 | 25% | 75% | 25% |

| 3 | 12.5% | 87.5% | 12.5% |

Additional Considerations

Other factors to consider when depreciating IT assets include:

1. Monthly Depreciation: Some businesses prefer to calculate depreciation every month to align with their financial reporting periods.

2. Intangible Assets: Intangible assets like software licenses also require depreciation using specific methods outlined in accounting standards.

3. Capitalized Assets: Assets above a certain cost threshold may be capitalized and depreciated over time, while smaller assets may be expensed immediately.

“Regular monitoring of your depreciation schedule is essential. Factors such as changes in asset usage, technological advancements, or

unexpected wear and tear may necessitate adjustments to the depreciation amounts.”

How can Unduit Asset Management help?

Unduit’s IT Asset Management (ITAM) platform empowers businesses to manage IT assets with precision, ensuring optimal depreciation tracking and value recovery. Our solution provides clear visibility into asset performance, enabling data-driven decisions to maximize return on investment.

Key Features for Depreciation and Value Recovery

I. Tailor rules to specific asset types (e.g., laptops, servers) and manufacturers for accurate tracking.

II. Choose from methods like straight-line or declining balance to suit financial strategies.

III. Define asset useful life and depreciation periods for automated, real-time value updates.

IV. Automatically calculate and update asset values, streamlining budgeting and compliance.

V. Identify underutilized assets for redeployment, resale, or recycling to recover maximum value.

Tips for Optimizing Your IT Assets Useful life

Don’t buy IT assets in bulk – unless you need it: The more your assets sit on the shelf the faster they depreciate because the technology will obsolete over time without being used. You can use our IT asset saving calculator as well to find out IT asset ROI.

☑ Keep track of Warranties – Once the warranty expires you will have to spend on maintenance from your pocket, keeping track of warranties helps you utilize them better.

☑ Regular hardware audits can help in making better decisions – Get insight into your device health so you know when to retire or upgrade your fleet.

☑ Keep up with the regular maintenance – General maintenance like cleaning and updating software can help you save residual/salvage value.

☑ Leverage robust asset management systems – Partnering with IT asset management companies takes away the load of maintaining track of everything, they can also help you optimize inventory management for you.

☑ Focus on asset sustainability practices. Reusing, refurbishing, and remarketing not only help in elongating the device lifecycle but also help you in extracting maximum return on your IT assets.

☑ Rental vs purchase IT assets – Renting eliminates the cost of ownership, you don’t have to pay a hefty upfront cost and you can access the latest technology whenever you want.

Frequently Asked Questions (FAQs)

1. What is fixed asset depreciation?

Fixed asset depreciation is the process of allocating the cost of tangible assets, such as IT equipment, over their useful life. This reflects the decrease in value of these assets over time due to wear and tear, obsolescence, and usage.

2. Why is depreciation important for IT assets?

Depreciation is crucial for IT assets as it helps in accurately reflecting their current value on financial statements, ensuring proper accounting and tax reporting. It also aids in budgeting for replacements and upgrades.

3. Which IT assets are subject to depreciation?

Tangible IT assets like computers, laptops, printers, servers, and networking equipment are typically subject to depreciation. Intangible assets such as software licenses may also be depreciated but follow different accounting rules.

4. How do I determine the useful life of an IT asset?

The useful life of an IT asset can vary based on its type, usage, and technological advancements. For example, laptops and computers typically have a useful life of 3 to 5 years.

5. What are the common methods of depreciation for IT assets?

Common methods include:

- Straight Line Depreciation: Evenly spreads the cost over the asset’s useful life.

- Declining Balance Depreciation: Accelerates depreciation, with higher expenses in the early years.

- Units of Production Depreciation: Links depreciation to the asset’s usage or production levels.

- Sum of the Years’ Digits Method: Recognizes higher expenses in the early years.

6. What is salvage value and how does it impact depreciation?

Salvage value is the estimated residual value of an asset at the end of its useful life. It is subtracted from the asset’s cost to determine the total depreciable amount. For many IT assets, the salvage value is often negligible.

7. How is straight line depreciation calculated?

Straight-line depreciation is calculated using the formula:

Depreciation per year = (Cost – Salvage Value) / Useful Life

8. What is the declining balance method of depreciation?

The declining balance method is an accelerated depreciation method where the asset depreciates faster in the initial years. The depreciation expense is calculated as a percentage of the asset’s book value at the beginning of each year.

9. Can I change the depreciation method after selecting one?

Changing the depreciation method is generally discouraged and may require approval from tax authorities or adherence to specific accounting standards. It’s best to consult with a financial advisor or accountant before making such changes.

10. How often should I review my depreciation schedule?

Regular reviews of your depreciation schedule are essential, especially when there are changes in asset usage, technological advancements, or unexpected wear and tear. This ensures an accurate reflection of asset values.

11. How does depreciation impact financial statements?

Depreciation expenses reduce the net income reported on the income statement. Accumulated depreciation, which reflects the total depreciation of an asset over time, is recorded on the balance sheet, reducing the asset’s book value.

12. Are there tax benefits to depreciating IT assets?

Yes, depreciating IT assets can provide tax benefits as it allows businesses to deduct depreciation expense from their taxable income, reducing the overall tax liability.

13. What is the impact of not depreciating IT assets?

Not depreciating IT assets can lead to inaccurate financial statements, overstating asset values, and net income. This can result in financial mismanagement and non-compliance with accounting standards.

14. What are some best practices for managing IT asset depreciation?

- Conduct regular hardware audits.

- Keep track of warranties and maintenance schedules.

- Utilize robust asset management systems.

- Partner with IT asset management companies for better inventory management.

- Focus on asset sustainability practices like reusing and refurbishing.

15. How does depreciation differ for intangible assets?

Intangible assets like software licenses follow different depreciation rules and methods, often referred to as amortization. The principles are similar but are tailored to the nature of intangible assets.

16. Can IT asset depreciation be optimized?

Yes, IT asset depreciation can be optimized by regularly reviewing and updating depreciation schedules, maintaining proper records, and using effective asset management strategies. Partnering with an ITAD company can also help streamline this process.

17. What should businesses consider when choosing a depreciation method?

Businesses should consider factors such as asset type, usage patterns, financial goals, and accounting standards. Consulting with a financial advisor or accountant can help determine the most suitable method.